Mortgage tools, all in one place

Get a Mortgage in Principle to see how much a mortgage lender could lend to you, and use our helpful range of mortgage calculators to help understand how much you can afford.

As seen in The Telegraph and This is Money

Important information

Your home may be repossessed if you do not keep up repayments on your mortgage. There may be a fee for mortgage advice. The actual amount you pay will depend on your circumstances. The fee is up to 1% but a typical fee is £495.

Why choose Reside?

Here for you, not the lenders

Our expert team delivers exceptional service with clear advice, tailored support, and a personal touch from start to finish.

Access to exclusive deals

We work with a wide range of lenders, from major banks to specialist providers, giving you access to over 10,000 mortgage deals across the market.

We're here to make it simple

From start to finish, we guide you through the process - handling every detail so you can enjoy a smooth, stress-free experience.

We work around you

Whether you prefer to chat online or over the phone, we work around your schedule - not the other way around.

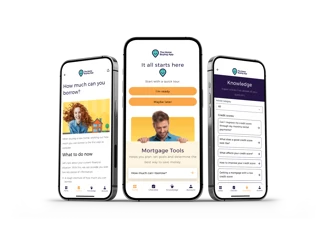

Get mortgage ready with our free Home Buying App!

Our Home Buying App is a digital mortgage coach designed to help you save up, plan, and track your home buying journey – whether you’re buying your first home, or fancy a move.

Don't forget to use our broker code: